The CF Story

The story of Cadillac Fairview began in Toronto more than 60 years ago, when three friends, Eph Diamond, Joseph Berman and Jack Kamin, started their own construction company. While they initially disagreed on what to name their new venture, the three eventually found inspiration in Kamin’s car, a Cadillac, which became the company’s namesake.

The Beginning

![[History] embed image 1](https://assets.cadillacfairview.com/transform/1e4b2b44-b03b-4ccd-980a-c188991fc503/Eph-Diamond-president-1969?quality=80)

When confronted by General Motors (GM), producer of the Cadillac, the illustrious trio argued that the name was in the public domain, having belonged to the French explorer who founded the city of Detroit. The partners came to an agreement with GM, which subsequently registered the trade name, prohibiting its use by anyone else.

1953

Cadillac Development Corporation Limited: A New Company

In 1953 the partners opened the doors to the Cadillac Development Corporation Limited. It was perfect timing, as they found themselves right in the middle of the post-war baby boom. The demand for new housing was tremendous and the company quickly set to work developing high rise apartment buildings in Guelph, Ontario.

Innovation became their trademark, as the company revolutionized the design of apartment buildings. Features that are taken for granted now, such as health club facilities, individually controlled heating and air conditioning, underground parking, and grounds landscaped with trees and fountains, were pioneered by Cadillac Development.

“We saw that consumers filled up their shopping carts, jockeyed for grocery delivery slots and cleared shelves of staples”

1960s

The Fairview Corporation Shares the Real Estate Limelight

In the early 1960’s, another company was busy building a reputation in the Canadian real estate industry. The Fairview Corporation was established as a division of Cemp Investments Ltd., the holding company for the Bronfman family, one of Canada’s most successful business dynasties.

Fairview and the Toronto-Dominion Bank joined forces with the goal of building the largest office complex in the country. Mies van der Rohe, an internationally renowned architect, was chosen to design the landmark project, the Toronto-Dominion Centre. The original concept called for a 1 million square foot office tower, which eventually expanded to include multiple towers totaling over 4 million square feet.

Over the next decade, principals from Cadillac and Fairview crossed paths through shopping centre developments and a joint purchase of Canadian Equity and Development Co., which owned 80,000 acres in an area near Toronto called Erin Mills. The district was in need of housing and access to shopping centres. As both Cadillac and Fairview began to expand their areas of operation, conflicts arose over the Erin Mills development. The two companies sought a solution.

1974

Cadillac & Fairview Merge

In the spring of 1974, two of the most dynamic forces in the Canadian real estate industry agreed to merge. A quick flip of a coin positioned the Cadillac name before Fairview, and a new real estate powerhouse was born.

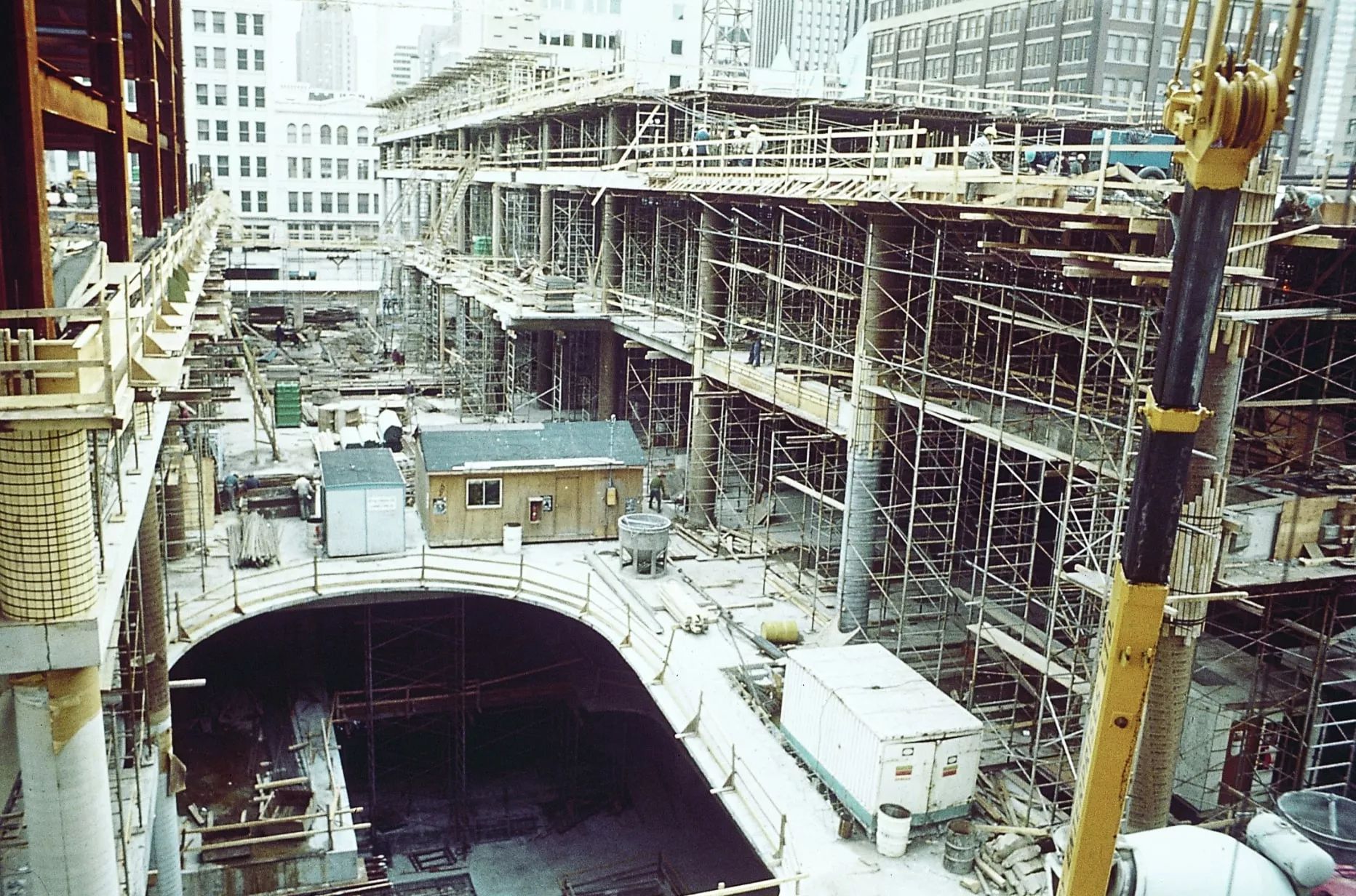

Cadillac Fairview continued its successful association with the Toronto-Dominion Bank, and along with a new partner, the T. Eaton Company, launched two other landmark projects: Vancouver’s Pacific Centre (opened in phases starting in 1971) and the Toronto Eaton Centre (opened in phases starting in 1977).

1975

Expansion to the United States

In 1975, Cadillac Fairview entered the U.S. real estate market.

1980S

Turbulent Times in Real Estate

In the early 1980s, as rising interest rates impeded revenues across the industry, Cadillac Fairview made the strategic decision to sell its Land and Housing division over a period from 1982 to 1985.

By the end of 1986, the Bronfman family agreed to sell their interest in Cadillac Fairview. At the same time, a former Cadillac Fairview executive organized an investor group to purchase the U.S. office portfolio.

On November 2, 1987, a consortium of 39 mostly American institutional investors, which had been put together by Chicago-based real estate developer JMB Realty Corp., purchased all outstanding shares of Cadillac Fairview for about $2.6 billion.

A streamlined Cadillac Fairview strengthened its commitment to the business of owning, managing and developing commercial real estate. However, a recession in the early 1980s took a toll. The slump resulted in high rates of retail tenant bankruptcies, shopping centre vacancies and an oversupply of office space. Cash flow and asset values plummeted at CF, adding to the financial strain of debt accrued during the leveraged buyout in taking Cadillac Fairview private. CF executives decided to undertake a financial restructuring.

1995

Strategy for Success

In July 1995, under a restructuring plan, a total of $832 million in additional capital was injected from a new group of investors into the Company. The investor group recruited a new CEO, Bruce Duncan, in December 1995, who put together a fresh management team during 1996. On November 6, 1997 an initial public offering raised an additional $304 million (CAD), completing one of Canada’s most successful corporate turnarounds.

The executive team opted to reinvent the company as the real estate investment vehicle of choice for investors and the dominant retail franchise in Canada. As a result, subsequent management efforts focused on strengthening existing dominance in current markets and controlling new markets. By September 1999, CF proved the strategy’s success and announced that a newly robust Cadillac Fairview was for sale.

1999

Teachers’ Buys Cadillac Fairview

By December 1999 the new Cadillac Fairview was on its way to becoming a wholly-owned subsidiary of the Ontario Teachers’ Pension Plan whose relationship with Cadillac Fairview began in 1995 (when Cadillac Fairview was publicly traded, Teachers’ was the largest shareholder holding approximately 21.8% of the outstanding common shares.)

With over $68 billion in assets, Teacher's saw this acquisition of Cadillac Fairview as an excellent opportunity to attain a desired level of allocation in the real estate sector while providing a good level of return for the active and retired Ontario teachers for whom it invests. The acquisition was finalized in mid-March 2000. (For more information, please visit Ontario Teachers’ Pension Plan)

2010-2020

2010-2020: The Reinvestment Decade

The last decade marked a significant period of redevelopment activity within CF’s existing asset portfolio.

Anticipating changing consumer and client demands and the need to maintain its leadership position, CF invested billions of dollars into revitalizing a broad cross-section of properties across Canada.

A series of major renovations began with the flagship CF Toronto Eaton Centre, which set the new industry benchmark for creating a unique shopping experience through interior enhancements and public amenities, while introducing a range of upscale dining options. CF launched subsequent renewal projects in major urban shopping centres across Canada. The company’s commercial office properties similarly benefitted from multimillion dollar reinvestments in updated interior and exterior design and advanced environmental technologies.

This decade of reinvestment delivered on CF’s purpose and promise to create a premium experience for occupants, clients and shoppers alike.

![[OurStory][History] banner](https://assets.cadillacfairview.com/transform/17e8ae91-c41a-47d5-a6b3-0fd851a62da2/-History-banner-1?quality=80)

![[Our Story][1953] Banner](https://assets.cadillacfairview.com/transform/fc1c2b6b-068e-4ce0-92e3-395030dd3acb/-History-banner-2?quality=80)